Let The Numbers Do The Talking...

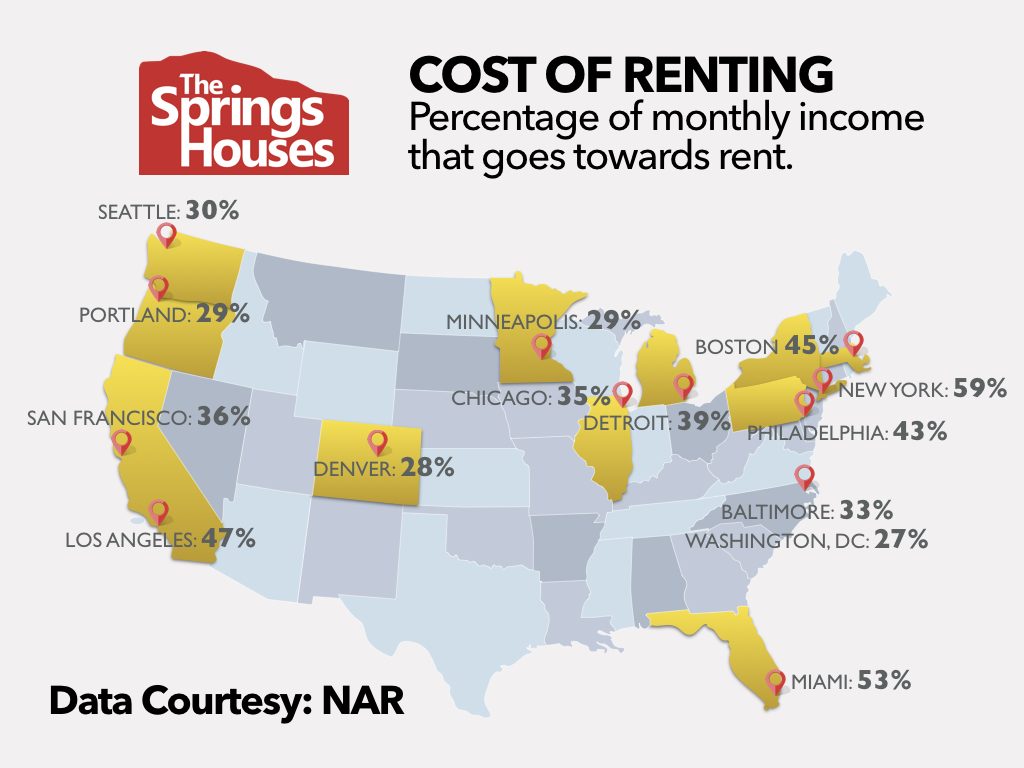

If you are currently renting in North Colorado Springs, it is important that you are aware of some of the benefits to purchasing a home instead of continuing to rent. Again, this is something that has to work financially for you. Don't believe anyone if they tell you "if you're renting, you should be buying" because it's just not true for everybody. It also depends widely on where you happen to live. Rents in Colorado Springs are much more affordable than other cities in the US. Check out this map that details the percentage of monthly income that it takes to make a rent payment in the most expensive US cities:

Even though we don't live in one of these ultra-expensive cities, the numbers still make a lot of sense to consider buying something instead of paying rent. Watch this video to get an overview of why it makes sense to considering buying versus renting:

The examples below presume a monthly rental cost of $1,200 a month. Loan details: 3.75% interest with an annual income between $65,101 - $131,450. Your totals may vary slightly based on income and current interest rates.

| 0% Down | 5% Down | 10% Down | |

|---|---|---|---|

| Loan Type: | VA | FHA | Conv. |

| Price | $200,000 | $200,000 | $200,000 |

| Monthly PITI | $1,450 | $1,294 | $1,192 |

| Down Payment | $0 | $10,000 | $20,000 |

| Average Annual Interest | $7,366 | $6,998 | $6,630 |

| Annual Tax Savings | $1,841 | $1,749 | $1,657 |

| Adjusted PITI | $1,296 | $1,148 | $1,053 |

| Your Rent | $1,200 | $1,200 | $1,200 |

| Monthly Difference | + $96 | - $52 | - $147 |

| 10 Year Appreciation (2%) | $43,799 | $43,799 | $43,799 |

Now consider the fact that your monthly rent will be increasing steadily over the term of that mortgage, while your mortgage payment will stay the same. The following chart shows how much your rent will increase over the next ten years, assuming a very conservative 2% increase year over year.

| Rental Payment | Mortgage Payment | ||

|---|---|---|---|

| 2013 | $1,200 | $1,192 | |

| 2023 | $1,462 | $1,192 |

In this example, over the course of the next ten years your rent will increase a minimum of $262 a month, while your mortgage payment remains constant. On top of that, this home investment would have increased in value over $40,000...all the while saving you money each and every month.

Since this is just an example, I strongly suggest you visit with a mortgage lender to determine if the numbers work similarly for you. I am happy to refer you to a local mortgage company if you need one.